Conduct of Business Sourcebook (COBS)

The rules on open market options are found in COBS 19.4 and we consider some of them here:

COBS 19.4.5 – A firm must give a retail client an open market options statement:

COBS 19.4.6 – Information that must be included in the statement

- The fact sheet Your pension: it’s time to choose or a statement that gives materially the same information (as set out in COBS 4.7).

- A summary of a retail client’s open market options, sufficient for the client to be able to make an informed decision about whether to exercise or decline open market

- Information about the retail client’s pension scheme

- A clear and prominent statement about the availability of pension guidance

COBS 19.4.8 – An open markets option statement must not include an application form for a pension decumulation product

COBS 19.4.9 – At least six weeks before the client’s intended retirement date, the firm must:

- remind the retail client about the open market options statement;

- tell the client what sum of money will be available to exercise open market options;

- remind the client about the availability of the pensions guidance; and

- recommend that the client seeks appropriate guidance or advice to understand their options at retirement.

COBS 19.4.10 – The six week reminder must not include an application form for a pension decumulation product.

COBS 19.4.11 – A firm must not provide a key features illustration (KFI) to a retail client for a pension decumulation product, excluding a small lump sum payment, unless:

- it is required to provide the client with the KFI in accordance with the rules on providing product information to clients (as set out in COBS 14.2.1R);

- the client requests the KFI without prompting by the firm;

- it includes a KFI for each of the pension decumulation product options that it offers; or

- it includes multiple KFIs as indicative representations of each pension decumulation product option that it offers.

COBS 19.4.12 – When a firm communicates with a retail client about pension annuities, it must provide the client with information about how their circumstances can affect retirement income calculations and payments for those offered by the firm and on the open market.

COBS 19.4.13 – Provides examples of circumstances that may affect the level of annuity income, including:

- the client’s marital status;

- whether the client has dependants;

- whether the pension annuity provides a fixed, increasing or decreasing income;

- the certainty of income associated with an annuity;

- the client’s state of health; and

- the client’s lifestyle choices.

COBS 19.4.14 – When communicating with a retail client about drawdown and UFPLS, the firm must provide the client with the information necessary to enable them to make an informed decision. This should, where relevant, include information about the:

- sustainability of income over time, including the extent to which any income is guaranteed and the implications of full encashment on the client’s retirement income;

- need to review, make further decisions about, or take further actions during the life of the pension decumulation product;

- impact on means-tested benefits;

- effect of costs and charges on the client’s income;

- tax implications; and

- how the remaining fund is invested.

COBS 19.4.15 – When communicating with a retail client regarding accessing their pension savings, the firm should have regard to the fair, clear and not misleading rule, the client’s best interests rule and Principles 6 and 7. It states that, in particular, a firm should:

- refer to the contents of the Money Advice Service fact sheet to identify what information might assist the client to understand their options;

- consider whether it needs to include or refer to any information contained in the Money Advice Service fact sheet;

- ensure the content, presentation or layout of any pension decumulation product information does not emphasise any potential benefits of the firm’s own products and services in a way that disguises or obscures important information or messages contained in the fact sheet;

- prominently highlight the ability to shop around and state clearly that other providers might offer pension decumulation products that are more appropriate for the client’s needs and circumstances and might offer a higher level of retirement income;

- present information in a logical order, using clear and descriptive headings and, where appropriate, cross-references and sub-headings to aid navigation; and

- where possible, use plain language and avoid the use of jargon, unfamiliar or technical language or, where this is not possible, provide easily accessible accompanying explanations in plain language.

COBS 19.4.16 – When a firm communicates with a retail client about that client’s personal pension scheme, stakeholder pension scheme, FSAVC, retirement annuity contract or pension buy-out contract, the firm must:

- refer to the availability of the pensions guidance;

- offer to provide the client with information about how to access the pensions guidance; and

- include a recommendation that the client seeks appropriate guidance or advice to understand their options at retirement.

The firm is not required to provide the above information where the:

- firm communicates with the client for a purpose other than to encourage them to think about their open market options or facilitate access to their pension savings; or

- client has already accessed their pension guidance; or

- client has already received advice from a firm on their open market options, for example from an independent financial adviser; or

- firm is providing the client with an open market option statement or six-week reminder in accordance with COBS 19.4.5 or 19.4.9.

COBS 19.4.17 – Provides examples of behaviour likely to contravene the client’s best interest rule or Principle 6, i.e. behaviour that:

- leads the client to believe that using the pensions guidance is unnecessary or would not be beneficial; or

- obscures the statement about the availability of the pensions guidance or any other information relevant to the exercise of open market options.

COBS 19.4.18

A firm receiving an application from a retail client to access some, or all, of their pension savings must provide them with a description of the tax implications before the client accesses their pension savings.

COBS 19.9 – From 1 March 2018 new rules were introduced in COBS 19.9 setting out the requirements for annuity comparison information. In particular these rules set out when a firm must provide a client with comparison information that shows whether the annuity they are offering will provide more or less income than the market leading pension annuity.

COBS 19.94 – states that a guaranteed quote provided to a client must follow a specified template (shown in COBS 19 Annex 3R) and must provide the following information:

- the cost of the pension annuity expressed as a single monetary value, net of any adviser charges;

- the amount and details of any adviser charges that the firm will be paying;

- the amount of any commission that will be paid, and details of who it will be paid to;

- the annual income the annuity will provide;

- details of any guarantee periods that apply to the income provided;

- the frequency of the income payments, including whether the payments are in advance or in arrears;

- details of any dependant’s or nominee’s pensions payable on the member’s death; and

- whether the income paid to the member will increase, and if so, the details of how this increase will be calculated.

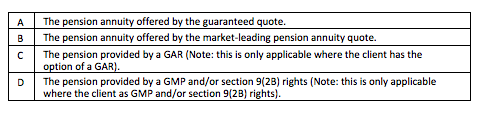

COBS 19.9.7 – states that a firm must generate a market-leading pension annuity quote before providing a guaranteed quote to a retail client. In doing so it must determine which of the following will provide the client with the highest annual income:

If B is the highest figure the provider must state by how much B exceeds A. They must also include a statement making it clear that the client could obtain a higher annual income by searching the open market for a pension annuity income.

Where C or D are (or are likely to be) the highest figures, the firm must include the monetary amount by which this income exceeds the income they are offering under A

The firm must also warn the client that their option to C or D will be lost if the client accepts their offer of A. Also, that by accepting A they will receive a lower income than under C or D.

COBS 19.9.11 – information on the client’s PCLS entitlement may have to be included in the information provided to the client (i.e. where they have an entitlement in excess of 25% of the value of the benefits in question). Where this is the case, a firm must warn a client if accepting the guaranteed quote or the market leading quote will reduce the PCLS the client would otherwise be entitled to.