Return to Solo 5 (RO4) course

Introduction & Glossary

Introduction

A money purchase scheme may be an occupational scheme provided by an employer for the benefit of the employees, or it may be an individual arrangement funded by the member (and sometimes by the employer as well). There are a few differences between these two and we will explain them in this chapter.

Key terms

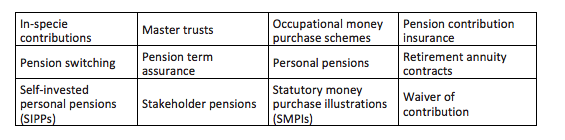

This chapter features explanations of the following terms and concepts: