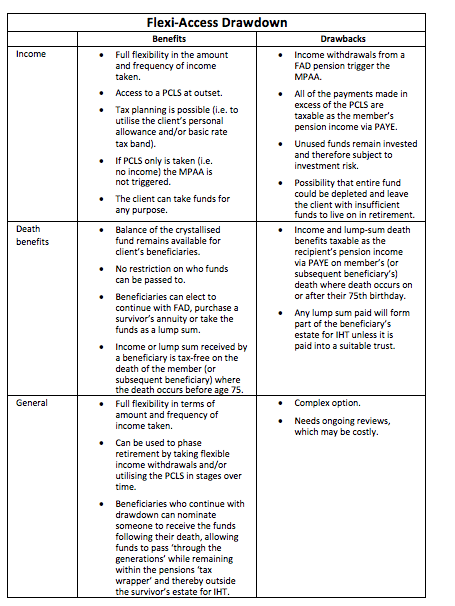

Benefits and drawbacks of Flexi-Access Drawdown

Question - Use Your Note Taker To Jot Down Ideas / Calculations

Audrey has a medium high attitude to risk and has no capacity for loss. She would like an income that is guaranteed to keep pace with inflation for her lifetime. Which of the following options are likely to be suitable for her purposes? Select all that apply.

a) UFPLS

b) Flexi-access drawdown

c) Conventional lifetime annuity

d) Scheme pension

e) Phased flexi-access drawdown

C & D)

She requires an income that increases with inflation for the rest of her life. This can only be provided by an annuity (either a lifetime annuity or a scheme pension). Furthermore, although she has a medium high attitude to risk she has no capacity for loss and a, b and e all remain subject to investment risk whereas c and d will be guaranteed to be paid for the rest of her lifetime.